International Real Estate Investment Poised to Double

Hawaii Real Estate Investments and Property Attractive to Chinese and Koreans

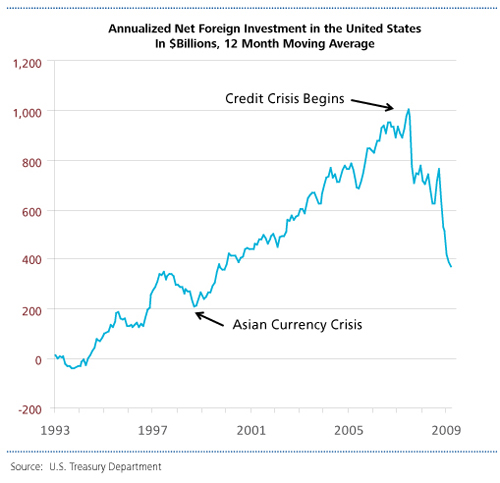

Investments from foreign sources into the U.S., particularly real estate investments, have continued to increase over the last several decades. The total U.S. Existing Home Sales market was approximately $1.07 trillion in the 12 months ending in March 2011 based on a recent NAR survey. Foreign clients purchased an approximate $41 billion share of homes, the same as the previous year. In addition, recent immigrants (who have moved to the U.S. within the past 2 years) and individuals with visas for more than 6 months purchased an additional $41 billion, for total internationally oriented sales of $82 billion, up from $66 billion reported in 2010.

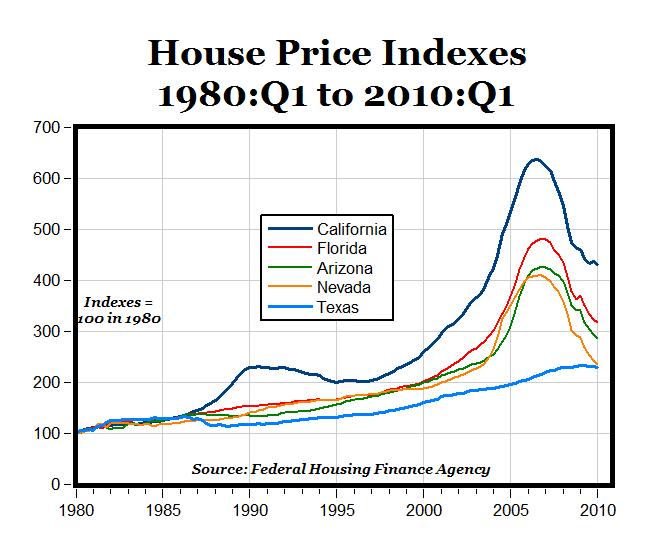

Geographic Market Segmentation: International buyers came from a total of 70 countries; the top five (Canada, Mexico, China, U.K., and India) accounted for 53 percent of transactions. Most states had at least one international transaction, but four states—Arizona, California, Florida, and Texas—accounted for 58 percent of transactions.

According to the NAR report, almost 80 percent of Realtors® reported that the value of the dollar had an impact on international sales. U.S. home prices have declined in recent years in both dollars and euros. When the euro’s value relative to the dollar increases the real price of a U.S. home to a euro based purchaser declines. During the past 10 years the strength of the euro has in general increased the purchasing power of international buyers. Declining U.S. home prices have also increased the attractiveness of the U.S. market. Due to the arbitrage nature of international currency markets, when the dollar depreciates against the euro it also tends to depreciate against other currencies, so overall the U.S. home buying market has become increasingly attractive to international purchasers.

The commercial property market in the U.S. is currently beset by both excess inventory and reluctance on the part of lenders to increase their current exposure to the market by lending further. Thus there is very little demand on the part of investors, domestic or foreign, to acquire commercial properties or begin new projects. The commercial market should improve as broader fundamentals in the economy improve; most notably employment and consumer spending, which should bolster property cash flows and improve capitalization rates, which in turn will help to stabilize commercial investment.

For the twelve months ending April 2010, foreign purchases of U.S. residences totaled $64 billion. This is almost twice the $36 billion in foreign transactions that took place during the twelve months ending April 2009. The percent of dollar volume represented by foreign transactions increased from 4.3% in 2009 to 7.1% in 2010.

Most of the foreign purchases in U.S. residential real estate were located in four states – Arizona, California, Florida and Texas.

These four states accounted for 54% of all international transactions in the twelve months ending April 2010. This compares to only 38% of all foreign transactions in the twelve months ending April 2007. Not surprisingly, states with a large number of distressed properties in vacation areas such as Florida and Arizona exhibited the biggest increases in foreign purchases. Foreign purchases in Florida and Arizona increased from 10% to 22% and 5% to 11% of all foreign transactions in the U.S. respectively between 2007 and 2010.

Foreign investment should improve as fundamentals in the commercial market stabilize. Attractive prices and a relatively weak dollar should entice foreign investors to return to U.S. commercial real estate. In regards to the residential market, low interest rates, a weak dollar, and attractive prices in traditional vacation areas should continue to attract foreign investment commensurate with recent levels.

EB-5 Visas

In 2010, nearly 2,000 would-be immigrants, many from China, applied for EB-5 visas, the most ever in a single year, according to U.S. Citizenship and Immigration Services (USCIS), the agency that oversees the program. The surge has been driven in part by a 20-fold increase in the number of U.S. companies looking to participate.

Direct Individual Investment Tax Implications

Advantages

Preferential long-term capital gain on a flat basis for capital assets held for more than 1 year

Lower acquisition cost

Easier to obtain institutional financing

Disadvantages

10% FIRPTA Withholding and 5% HARPTA Withholding at the time of sale. The N-288 forms are located here and here.

30% withholding tax on rental income unless an election is made to treat the rental income as effectively connected with U.S. trade or business income

Income Tax Implications

Rental income/expenses

Withholding Tax – 30% on payment made to a foreign person

Exception – Claim that income is effectively connected with a US trade or business

Form W-7 – Individual Identification Number

Form W-8ECI – Claim of income effectively connected with a US trade or business

Form 1042-S – Foreign person’s US source income subject to withholding tax

US tax treaties

Federal Income Tax – Graduate income tax rates

Hawaii Income Tax Graduate income tax rates

General Excise Tax – 4%

Transient Accommodations Tax – 9.25%

Honolulu City and County Surcharge Tax – 0.5%

State of Hawaii Tax Forms

Income Taxes

- Individual Income Tax – Resident and Nonresident

- Partnership Income Tax

- Corporate Income Tax

- S Corporation Income Tax

- Employer’s Withholding of State Income Tax

- Exempt Organization Business Income Tax

- Fiduciary (Trust and Estate) Income Tax

- REMIC – Real Estate Mortgage Investment Conduits Income Tax

General Excise, Use, Transient Accommodations, Rental Motor Vehicle Surcharge Taxes

- General Excise and Use Tax

- Transient Accommodations Tax

- Rental Motor Vehicle and Tour Vehicle Surcharge Tax

Other Taxes

- Banks and Financial Institutions

- Cigarette and Tobacco, and Liquor Tax

- Conveyance Tax

- Estate and Transfer Tax

- Fuel Tax

- HARPTA – Withholding Tax on Sales of Hawaii Real Property by Nonresident Persons

- Public Service Company Tax

- Miscellaneous Forms